Fitness

Industry

At INC, our agents are experts in crafting insurance solutions tailored specifically for the fitness industry's 1099/independent contractors. We comprehend the distinct needs and risks these individuals encounter and provide personalized guidance on crucial policies such as liability and property coverage. Our goal is to deliver comprehensive protection that addresses the unique challenges faced by independent fitness professionals. With a deep understanding of the intricacies of self-employment, INC insurance agents empower contractors in the fitness sector to make informed decisions for their financial well-being.

Keep your business in shape with affordable fitness insurance

Ensure your fitness business stays protected with affordable insurance solutions from INC Insurance. While you focus on elevating your clients’ heart rates, we’ll keep yours steady by swiftly and affordably covering all your risks. Save up to 10% when bundling two or more policies with us.

We specialize in sports and fitness insurance

Choose your profession for more information or get a

customized quote for your business

Why do fitness professionals need business insurance?

Certainly, while your clients may express gratitude for typical post-workout soreness, the scenario changes if they endure more severe discomfort. They might allege that your fitness coaching led to injury or emotional distress.

Having business insurance alleviates the burden of solely covering expenses to defend your business or address the issue.

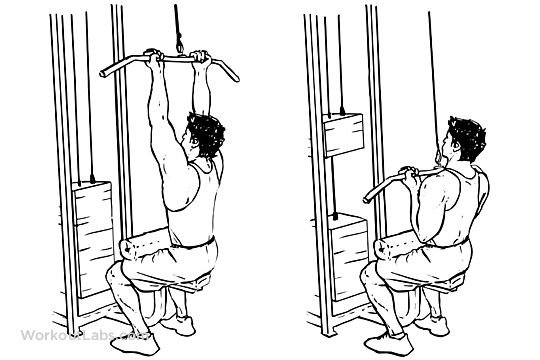

Fitness liability insurance

Fitness liability insurance offers coverage for costs incurred if someone accuses you of causing injury or property damage not belonging to you. Typically mandated for offering services in a gym or renting your own space.

Our business insurance packages blend two liability insurance types:

General liability, often the initial purchase for instructors, covers the primary risks faced daily—other people’s injuries and non-owned property damage.

Professional liability offers financial protection against claims of service non-delivery or providing advice leading to financial harm.

Other important business insurance coverage for fitness pros

Fitness liability insurance is essential for covering your bases, but you may also consider adding other types of business insurance to protect your cleaning equipment, work vehicles, and employees.

We typically recommend:

Health insurance

Fitness professionals rely heavily on health insurance to safeguard their well-being and financial stability. Unlike many corporate employees, those in the fitness industry often lack access to conventional employee benefit plans. In the absence of employer-sponsored benefits, reliable health insurance becomes a crucial safety net for covering essential medical expenses, preventive services, and unforeseen health-related costs. By ensuring access to comprehensive health coverage, we not only prioritize the health and fitness of individuals in the industry but also contribute to the overall resilience and longevity of their independent ventures.

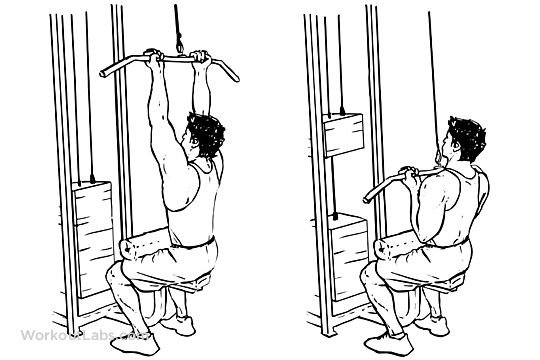

General Liability

Fitness professionals also greatly benefit from general liability insurance, a crucial safeguard against potential legal and financial risks within the industry. In the absence of employer-based coverage, independent fitness workers may find themselves personally responsible for accidents, property damage, or legal claims related to their work. General liability insurance steps in to alleviate these concerns by covering legal defense costs and potential settlements. This insurance provides a solid foundation, allowing independent fitness professionals to run their businesses confidently, ensuring both their financial security and the longevity of their assets.

Workers’ Compensation

If you’re a proactive coach or fitness instructor and sustain an injury like a broken ankle during practice, some of your medical expenses may be covered by workers’ compensation. Owners’ coverage is tailored for business owners who may not have employees but seek additional protection for themselves.

It’s important to note that without workers’ compensation, injuries sustained at work might not be covered by personal health insurance.

This coverage is mandatory for businesses with employees in every state except Texas.